modified business tax nevada instructions

Modified business tax nevada instructions Saturday February 26 2022 Edit. Gross wages payments made and individual employee.

Nucs 4072 Fill Online Printable Fillable Blank Pdffiller

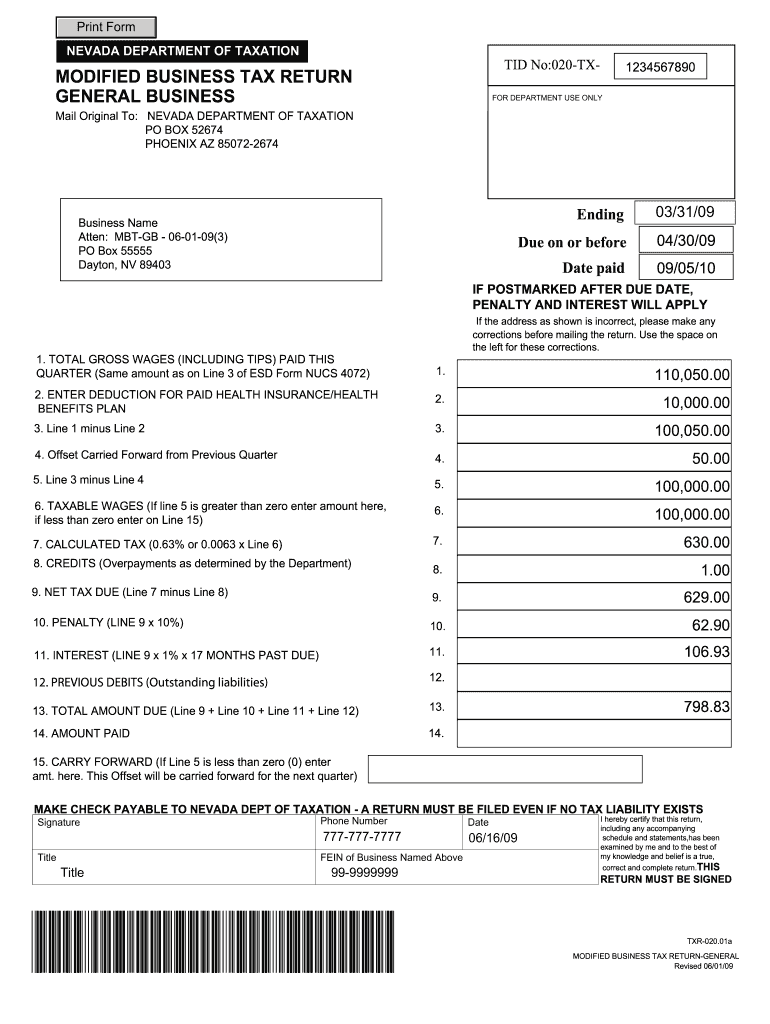

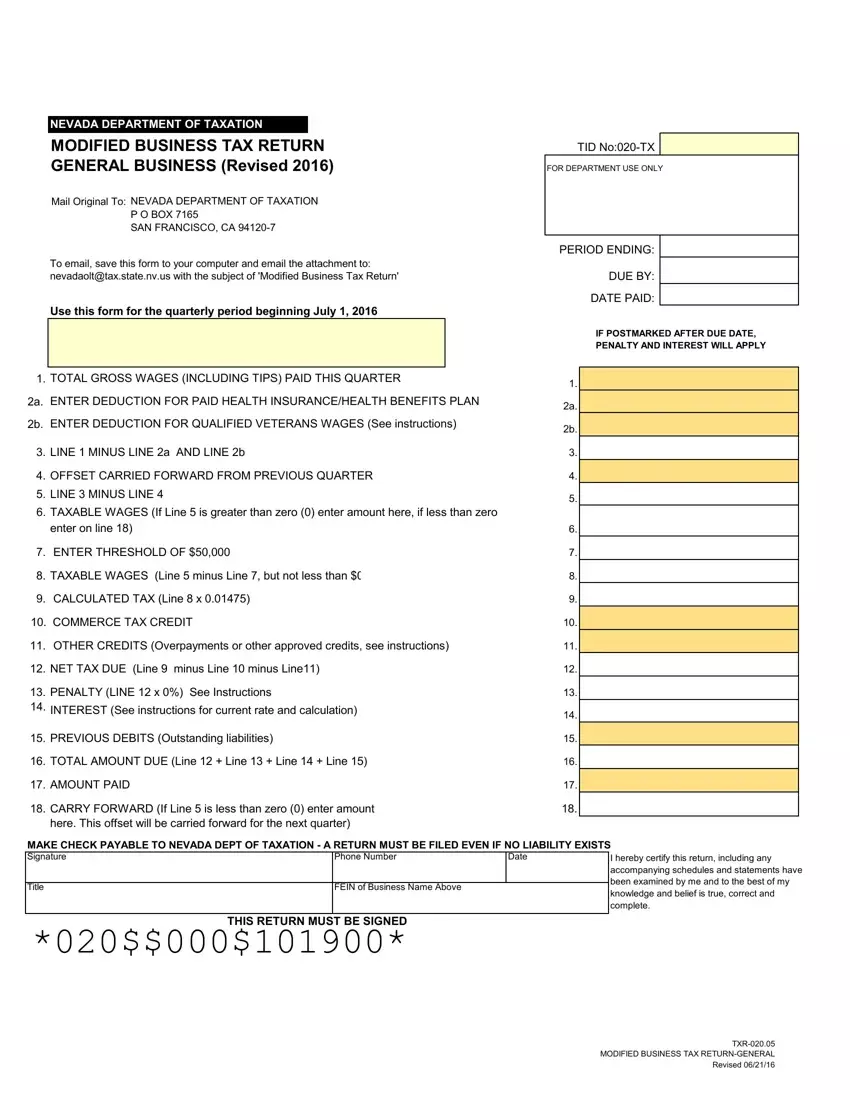

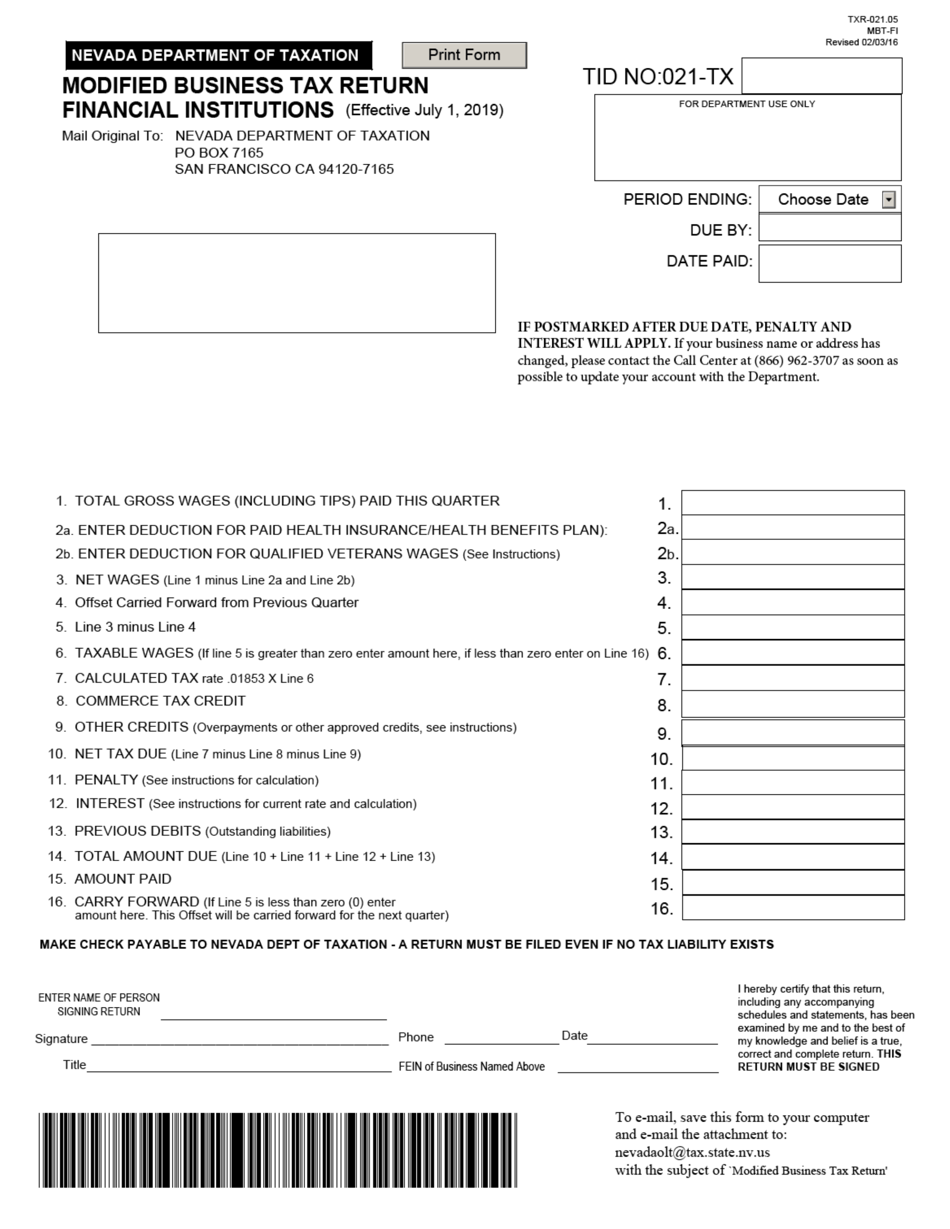

Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed.

. Therefore the signNow web application is a must-have for completing and signing nevada modified business tax form on the go. Qualifying employers are able to apply for an abatement of 50 percent. Nevada Modified Business Tax Return.

A Nevada Employer is defined as per NRS 363B030. Here is the responseanswer to your Frequently Asked Question. Complete the necessary fields.

If you have any questions about federal taxes you can contact the IRS at 800-829-4933. The following tax codes create transfers and liability records. Enter your Nevada Tax Pre-Authorization Code.

The tips below can help you fill out Nevada Modified Business Tax quickly and easily. The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience. Open the document in the full-fledged online editor by hitting Get form.

This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. 2 2 Form Txr 020 05 Mbt Gb Download Fillable Pdf Or Fill Online Modified Business Tax Return General. Creating a two-tiered tax rate in lieu of the single rate of 063 effective July 1 2009.

In a matter of seconds receive an electronic document. Nevada levies a Modified Business Tax MBT on payroll wages. Nevada levies a modified business tax mbt on payroll wages.

Their hours are 7am to 7pm Monday through Friday. MODIFIED BUSINESS TAX Nevada College Savings Trust Fund NRS 353B340 An employer is entitled to a credit against the Modified Business Tax per NRS 363A130 and NRS 363B110 if. BUSINESS TAX TRANSFERABLE TAX CREDITS.

SB 483 of the 2015 Legislative Session became effective July 1 2015 and changes the tax rate to 1475 from 117. Any employer who is required to pay a contribution to the Department of. Select the document you want to sign and click upload.

Modified business tax nevada instructions Friday March 4 2022 Edit. Every employer who is subject to Nevada Unemployment. For additional questions about the Nevada Modified Business Tax see the following page from the.

The Nevada Modified Business Return is an easy form to complete. 429 a non-financial employer paid a tax rate of 050 on taxable wages up to and quarter. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries.

Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. Film Credit NRS 360759. Taxable wages x 2 02 the tax due.

Click here to schedule an appointment. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the employer and certain wages paid to qualified veterans. Overview of Modified Business Tax.

Modified Business Tax NRS 463370 Gaming License Fees NRS 680B Insurance Fees and Taxes. Modified business tax nevada instructions Saturday February 26 2022 Edit. SalesUse Tax Permit Modified Business Tax Department of Taxation Local Business License 2 New Business OtherChange in Ownership Business Entity Change in Location.

Effective july 1 2019 the tax rate changes to 1853 from 20. Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan. It requires data and information you should have on-hand.

Clark County Tax Rate Increase - Effective January 1 2020. The documents found below are available in at least one of three different. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165.

However the first 50000 of gross wages is not taxable. Impounding and filing of the Nevada Business Tax is now supported. If the sum of all wages for the 915 quarter.

Additionally the new threshold is decreased from 85000 to 50000 per quarter. Federal State Contact Information. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to.

TurboTax Business is recommended if your small business is a partnership S Corp C Corp. If the sum of all taxable wages after health. Ask the Advisor Workshops.

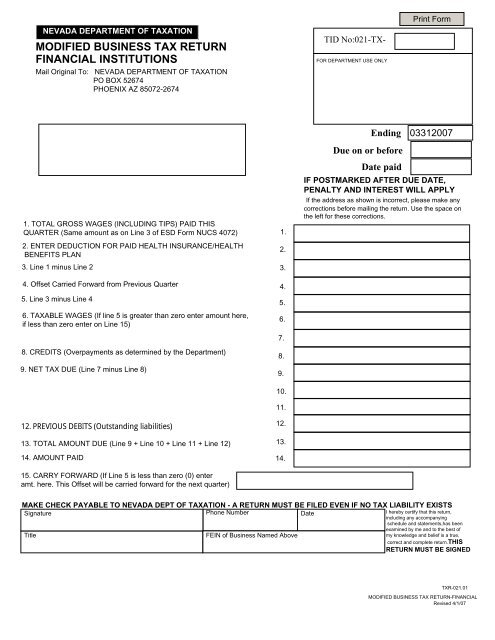

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Modified Business Tax Return Financial Institutions

How To File And Pay Sales Tax In Nevada Taxvalet

Modified Business Tax Return Financial Institutions

Modified Business Tax Form Fill Out Printable Pdf Forms Online

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions Nevada Templateroller

Modified Business Tax Return Financial Institutions

Have You Not Collected Or Remitted Your Nevada Sales Tax Yet Consider The Voluntary Disclosure Program Sales Tax Helper